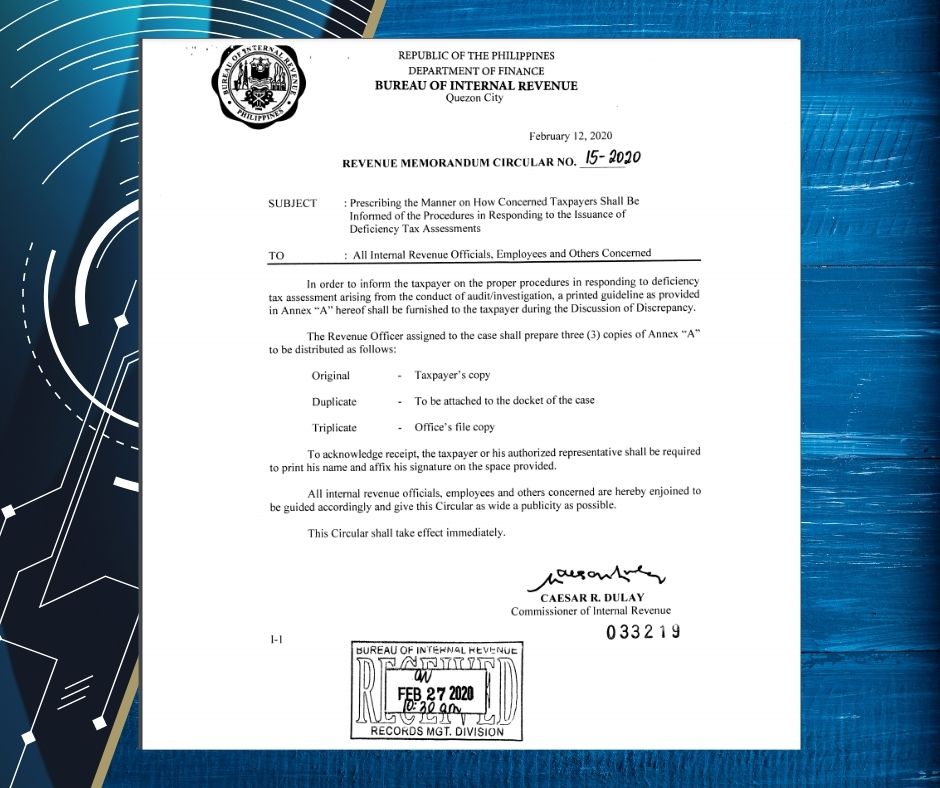

Revenue Memorandum Circular (RMC 15-2020)

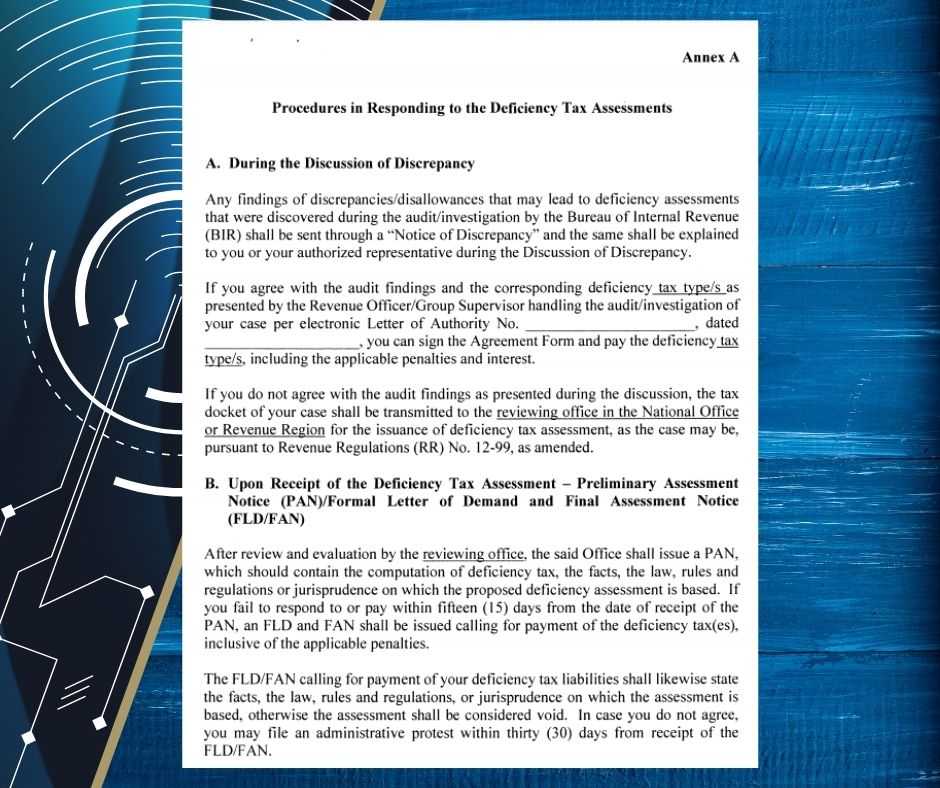

In order to inform the taxpayer on the proper procedures in responding to tax assessment arising from the conduct of audit/ investigation, a printed guideline as provided in Annex “A” hereof shall be furnished to the taxpayer during the Discussion of Discrepancy. The Revenue Officer assigned to the case shall prepare 3 copies of Annex “A” to be distributed as follows: taxpayer’s copy, to be attached to the docket of the case, office’s file copy. The taxpayer or his authorized representative shall be required to print his name and affix his signature on the space provided.

Decoding BIR Tax Enforcement, Assessment and Collection

Have you ever wished that there is a book that would properly explain the assessment process of the BIR?

Are you looking for a relevant, updated and easy-to-understand guide even for non-practitioners and professionals?

The long wait is over.

Decoding BIR Tax Enforcement, Assessment and Collection Book is a comprehensive guide to the assessment process of the Bureau of the Internal Revenue (BIR)