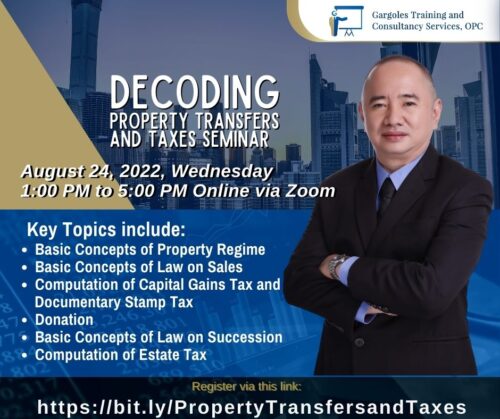

Decoding Property Transfers and Taxes Seminar

KEY TOPICS INCLUDED:

1. Basic Concepts of Property Regime

• Absolute Community of Property

• Conjugal Partnership of Gains

• Exclusive Property

2. Basic Concepts of Law on Sales

• Definition and Kinds of Contract of Sale

• Rule on Double Sales

• Transfer of Ownership

3. Computation of Capital Gains Tax and Documentary Stamp Tax

• Sale of Principal Residence (Exempt from Capital Gains Tax)

• Sale of Real Property

• Place and time of filing and payment

4. Donation

• Definition and requisites for Donation

• Revocation and Reduction of Donations

• Computation of Donor’s Tax

• Place and time of filing and payment

5. Basic Concepts of law on Succession

• Table of Legitimes (Sharing of heirs)

• The regular order of Succession

6. Computation of Estate Tax

• Notice of Death and Certification by CPA

• Composition of Gross Estate

• Valuation of Real and Personal Property

• Proceeds of Life Insurance

• Allowable deductions

• Place and time of filing and payments